Adding tax to estimate pricing

Simplify taxes within Bolster with preset sales tax (GST, HST, PST) per state or province. You can also create custom taxes for based on sales, materials, labor and subcontracted items.

Adding sales tax (GST, PST, HST) to estimates

Use taxes in Bolster to keep your totals accurate.

You can apply:

-

Canada taxes (GST, PST, HST)

-

US state sales tax

-

Custom taxes you define

How taxes work in Bolster

Bolster gives you a few options.

You can:

-

Automatically import custom taxes based on your province in Canada or your state in the US

-

Add a custom tax as a simple percentage

-

Apply taxes only to specific item types

-

Labor

-

Subcontracted items

-

Materials

-

This helps you match how you actually charge tax.

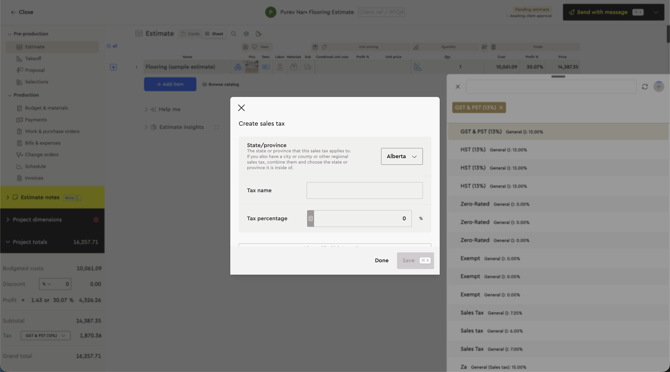

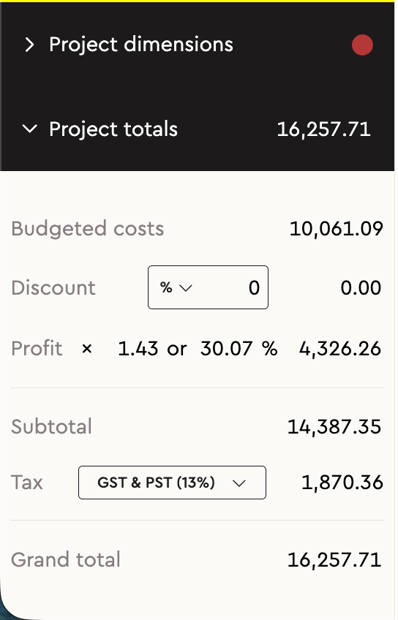

Add or change tax on an estimate

Follow these steps inside any estimate.

-

Open the estimate

-

Open Project totals in the bottom left

-

Click the tax name

-

Bolster opens a menu on the right

-

-

Select a tax from the list

If you don’t see the tax you need, add a new one.

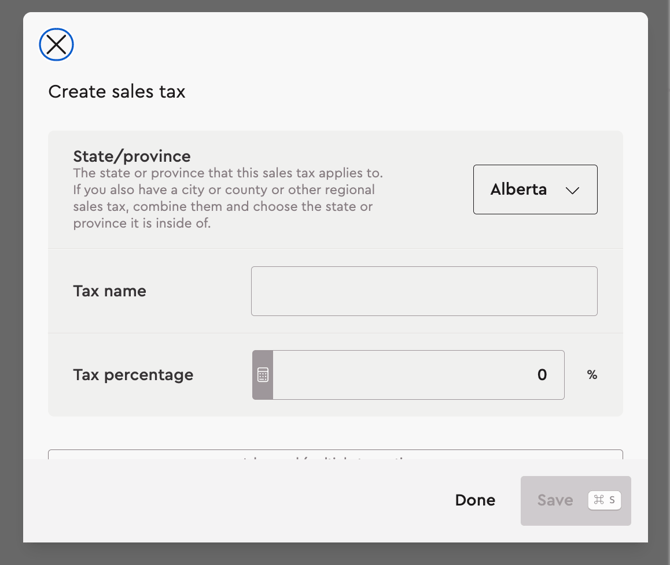

Add a new tax

From the same right-side tax menu:

-

Click the + button to add a new tax

-

Choose one of these options

-

Select a state/province for tax

-

Enter a percentage

-

-

Name the tax

-

Example: GST

-

Example: PST (BC)

-

Example: HST (ON)

-

Example: State Sales Tax

-

Save it.

Then apply it to the estimate from the tax list. Your grand total will include the tax chosen from this list.

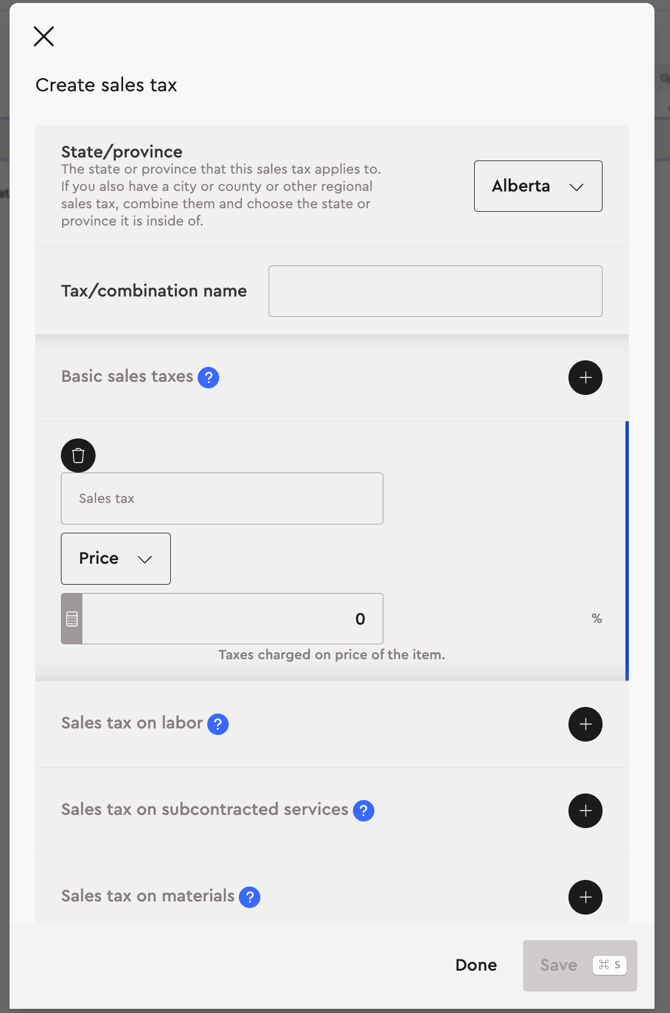

Advanced tax settings

If you need more control:

-

Click the Advanced button

You can set separate percentages for:

-

Basic sales taxes

-

Sales tax on labor

-

Sales tax on subcontracted services

-

Sales tax on materials

Use this when your tax rules differ by category.

Practical tips

Use these habits to avoid mistakes:

-

Match your tax name to what the client expects to see

-

Example: “HST (ON)” instead of “Tax”

-

-

Use Advanced settings when you tax labor differently than materials

-

Keep your tax setup consistent across estimates

What part of your estimate causes the most tax questions today: labor, materials, or subs?